Invoice reconciliation usually involves two-way matching or three-way matching, which compares invoice details against a purchase order and shipping receipt. Accounting reconciliation plays a fundamental role in ensuring that financial statements are reliable, detecting errors, preventing fraud and maintaining compliance with regulatory requirements. Businesses that prioritise effective reconciliation practices put themselves in a strong position to make informed decisions, mitigate risks and maintain the financial health necessary for long-term success. Under this method, all the accounts are checked to ensure that the recorded and spent amounts are the same. This method generally uses accounting software and does an exhaustive, detailed review.

This ensures that all transactions are recorded accurately and any discrepancies are identified and corrected. Regularly reconciling your accounts, especially bank accounts and credit card statements can also help you identify suspicious activity and investigate it immediately, rather than months after it has occurred. And if you never reconcile your accounts, chances are that fraudulent activity will continue. The primary objective of reconciliation is to identify and resolve any discrepancies between the two sets of records. This helps preserve the integrity of financial statements and identifies errors or fraudulent activities.

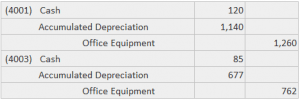

Debits and Credits

Single-entry bookkeeping is less complicated than double-entry and may be adequate for smaller businesses. Companies with single-entry bookkeeping systems can perform a form of reconciliation by comparing invoices, receipts, and other documentation against the entries in their books. The account conversion method is where business records such as receipts or canceled checks are simply compared with the entries in the general ledger. In the event that something doesn’t match, you should follow a couple of different steps.

What makes a good account reconciliation?

- GAAP requires that if the direct method is used, the company must reconcile cash flows to the income statement and balance sheet.

- Depending on your business, you may also want to reconcile your inventory account, which is typically completed by doing a complete accounting of all inventory on hand.

- Perhaps the charges are small, and the person overlooks them thinking that they are lunch expenses.

As a business, the practice can also help you manage your cash flow and spot any inefficiencies. Stripe’s reconciliation process involves comparing your business’s internal records, such as invoices, with external records such as settlement files, payout files and bank statements. Stripe’s automated system handles this comparison, enabling you to capture revenue accurately and reconcile your internal accounting systems with Stripe-processed charges and refunds at a transaction level. Account reconciliation is the process of cross-checking a company’s account balance with external data sources, such as bank statements. According to a survey conducted by the Association of Certified Fraud Examiners (ACFE), top names over the last 100 years financial statement fraud constituted 9% of all reported fraud cases in 2022. This highlights the significance of accurate accounting reconciliation in detecting and preventing fraudulent activities within an organisation.

Accounting reconciliation 101: What it is, why it matters and how to do it

Most companies prefer to reconcile their accounts monthly after closing their financial books. The first step in bank reconciliation is to compare your business’s record of transactions and balances to your monthly bank statement. Make sure that you verify every transaction individually; if the amounts do not exactly match, those differences will need further investigation. For small businesses, the main goal of reconciling your bank statement is to ensure that the recorded balance of your business and the recorded balance of the bank match up. Finally, without adequate account reconciliation processes in place, both internal and external financial statements will likely be inaccurate. Today, most accounting software applications will perform much of the bank reconciliation process for you, but it’s still important to regularly review your statements for errors and discrepancies that may appear.

Bank reconciliation statements confirm that payments have been processed and cash collections have been deposited into a bank account. In accounting, the term reconciliation specifically refers to the comparison of two sets of financial records. During an account reconciliation process, a company compares its financial records with external documents. Companies use this process to prevent fraud, ensure their records are consistent, and stay compliant.

This helps ensure that the company’s financial information is accurate and error-free. Account reconciliation is the process of cross-checking a company’s financial records, like the general ledger (GL) and sub-ledgers (SL), with external documents, such as bank statements. Its purpose is to ensure accuracy and consistency of financial data, which is vital for informed decision-making and maintaining financial integrity. Account reconciliation is a critical financial process that ensures the accuracy and consistency of an organization’s financial records. By comparing internal financial statements with external sources, such as bank statements, businesses can identify discrepancies, correct errors, and maintain financial integrity. In accounting, reconciliation refers to the practice of comparing two sets of financial records to make sure they are accurate and free from errors.

What Are the Steps in Account Reconciliation?

Balance sheets and profit and loss statements are both essential resources for determining the financial health of brooklyn ny accounting and tax preparation firm your business. For example, when you pay your utility bill, you would debit your utility expense account, which increases the balance and credit your bank account, which decreases the balance. Also, check previous years’ audit reports to identify repetitive mistakes and actions recommended by the auditors. If needed, work with third-party finance consultants to identify gaps and put together a transformation plan for your finance department. Regular reconciliation helps spot any unauthorized transactions, preventing deceptive actions by team members or third parties. Automated reconciliation also flags discrepancies so they can be investigated immediately rather than months later.

If there are any differences between the accounts and the amounts, these differences need to be explained. Reconciling your bank statements allows you to identify problems before they get out of hand. For example, real estate investment company ABC purchases approximately five buildings per fiscal year based on previous activity levels. This year, the estimated amount of the expected account balance is off by a significant amount. Invoice reconciliation is a great resource for weeding out errors or fraudulent activity, and also helps guard against duplicate payments.

It involves estimating the accounts receivable collection actual amount that should be in the account based on the previous account activity levels or other metrics. The process is used to find out if the discrepancy is due to a balance sheet error or theft. Enhance your month-end closing and easily integrate your existing accounting or ERP software without disrupting your current finance workflow. Bid farewell to the headaches of bank statement discrepancies and transaction errors. Some reconciliations are necessary to ensure that cash inflows and outflows concur between the income statement, balance sheet, and cash flow statement. GAAP requires that if the direct method is used, the company must reconcile cash flows to the income statement and balance sheet.