PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. The company owes $0 after this payment, which is $10,999 – $10,999. The company owes $10,999 after this payment, which is $21,474 – $10,475. The company owes $21,474 after this payment, which is $31,450 – $9,976. The company owes $31,450 after this payment, which is $40,951 – $9,501.

What is your risk tolerance?

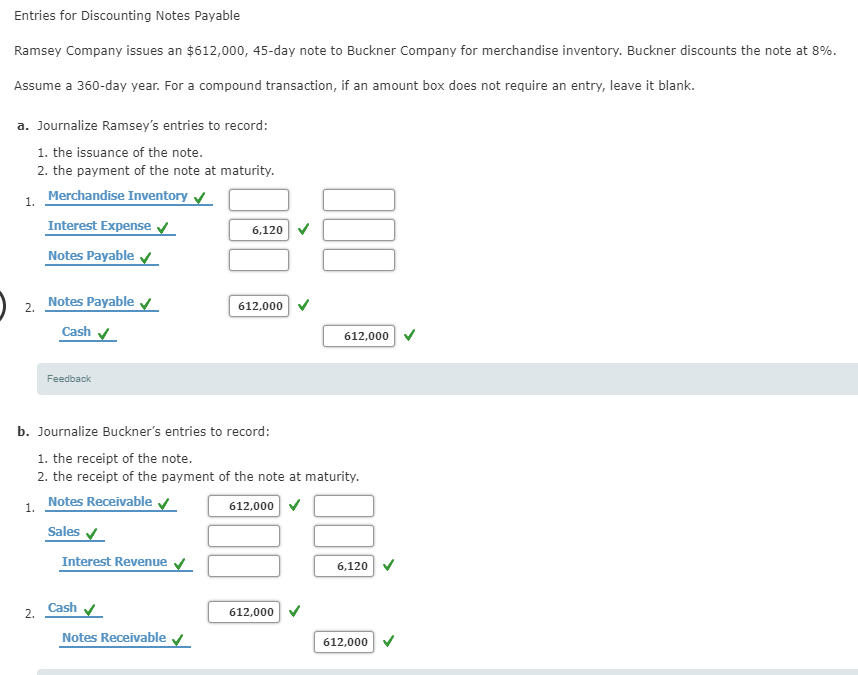

This is due to the interest expense is the type of expense that incurs through the passage of time. The notes payable is an agreement that is made in the form of the written notes with a stronger legal claim to assets than accounts payable. The company usually issue notes payable to meet short-term financing needs. As the length of time to maturity of the note increases, the interest component becomes increasingly more significant. As a result, any notes payable with greater than one year to maturity are to be classified as long-term notes and require the use of present values to estimate their fair value at the time of issuance. A review of the time value of money, or present value, is presented in the following to assist you with this learning concept.

Present Values: When Stated Interest Rates Are Different Than Effective (Market) Interest Rates

A firm may issue a long-term note payable for a variety of reasons. For example, notes may be issued to purchase equipment or other assets or to borrow money from the bank for working capital purposes. The note payable issued on November 1, 2018 matures on February 1, 2019. On this date, National Company must record the following journal entry for the payment of principal amount (i.e., $100,000) plus interest thereon (i.e., $1,000 + $500).

- A review of the time value of money, or present value, is presented in the following to assist you with this learning concept.

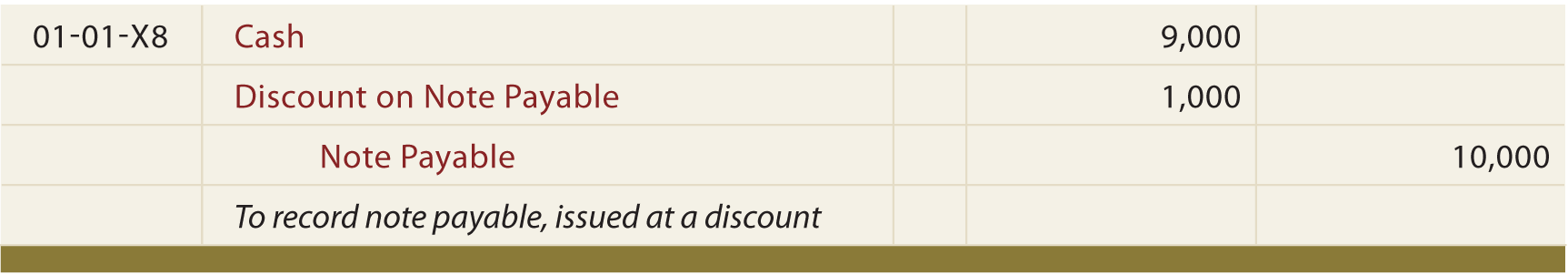

- The difference between the face value of the notes payable and the cash received is referred to as the discount, and represents the cost to the business of issuing the note.

- Only interest payments are typically due on notes payable until maturity, as is the case with the bonds used as examples here.

- During 2023, Empire Construction Ltd. experienced some serious financial difficulties.

How much will you need each month during retirement?

The cash amount in fact represents the present value of the notes payable and the interest included is referred to as the discount on notes payable. In this case the note payable is issued to replace an amount due to a supplier currently shown as accounts payable, so no cash is involved. Notes payable are liabilities and represent amounts owed by a business to a third party.

Create a Free Account and Ask Any Financial Question

Also, the process to issue a long-term note is more formal, and involves approval by the board of directors and the creation of legal documents that outline the rights and obligations of both parties. These include the interest rate, property pledged as security, payment terms, due dates, and any restrictive covenants. Restrictive covenants are any quantifiable measures that are given minimum threshold values that the borrower must maintain.

A note payable has a par or face value, which is the amount the borrower must repay when the note matures. Only interest payments are typically due on notes payable until maturity, as is the case with the bonds used as examples here. Discounted notes use the discount on notes payable account to record the discount and keep track of it was the note is repaid. The discount account is a contra liability account with a debit balance that reduces the recorded face value of the note to the actual amount received. As the note is paid off, the discount account will be amortized to interest expense over the life of the note.

Taking out a loan directly from the bank can be done relatively easily, but there are fees for this (and interest rates). Issuing notes payable is not as easy, but it does give the organization some flexibility. For example, if the borrower needs more money than originally intended, they can issue multiple notes payable. Generally, there are no special problems to solve when accounting for these notes. As interest accrues, it is periodically recorded and eventually paid.

As the name implies, a non interest bearing note or zero interest note, does not have an interest rate and does not charge periodic interest payments on the outstanding liability. In order for the lender to get a return on their zero interest notes payable, the notes are issued at a lower price than their face value. The debit of $2,500 in the interest discount on notes payable payable account here is to eliminate the payable that the company has previously recorded at period-end adjusting entry on December 31, 2020. As the interest expense incurs through the passage of time, this journal entry is necessary to recognize the interest expense of $2,500 that has incurred for 3 months from October 1, 2020 to December 31, 2020.